Income Tax Filing for FY 2024-25 Begins:

Choose Your Tax Regime Wisely

With the beginning of the Income Tax filing season for Financial Year (FY) 2024-25, the Central Board of Direct Taxes (CBDT) has notified ITR Form 1 (Sahaj) and ITR Form 4 (Sugam) for individuals and entities earning up to ₹50 lakh annually. This allows individuals, HUFs, and firms with income from business or profession to begin filing returns for income earned during FY 2024-25. These simpler ITR forms are aimed at easing compliance for small and medium taxpayers.

A crucial part of this process is determining your Income Tax Slab and deciding between the old and new tax regimes. Making an informed decision can significantly reduce your tax burden. Let’s explore the slabs, deductions, and recent updates to help you choose the optimal tax regime.

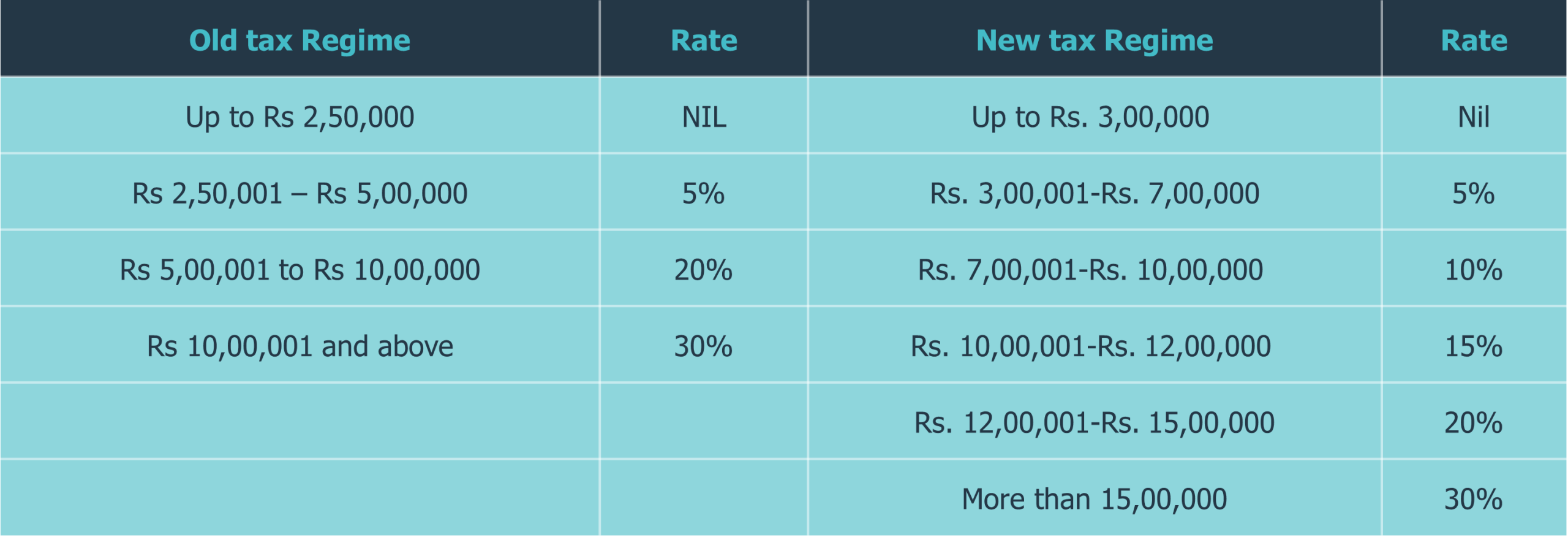

[A] Comparing the Old and New Regimes

Comparison of Old and New Regime for FY 2024-25:

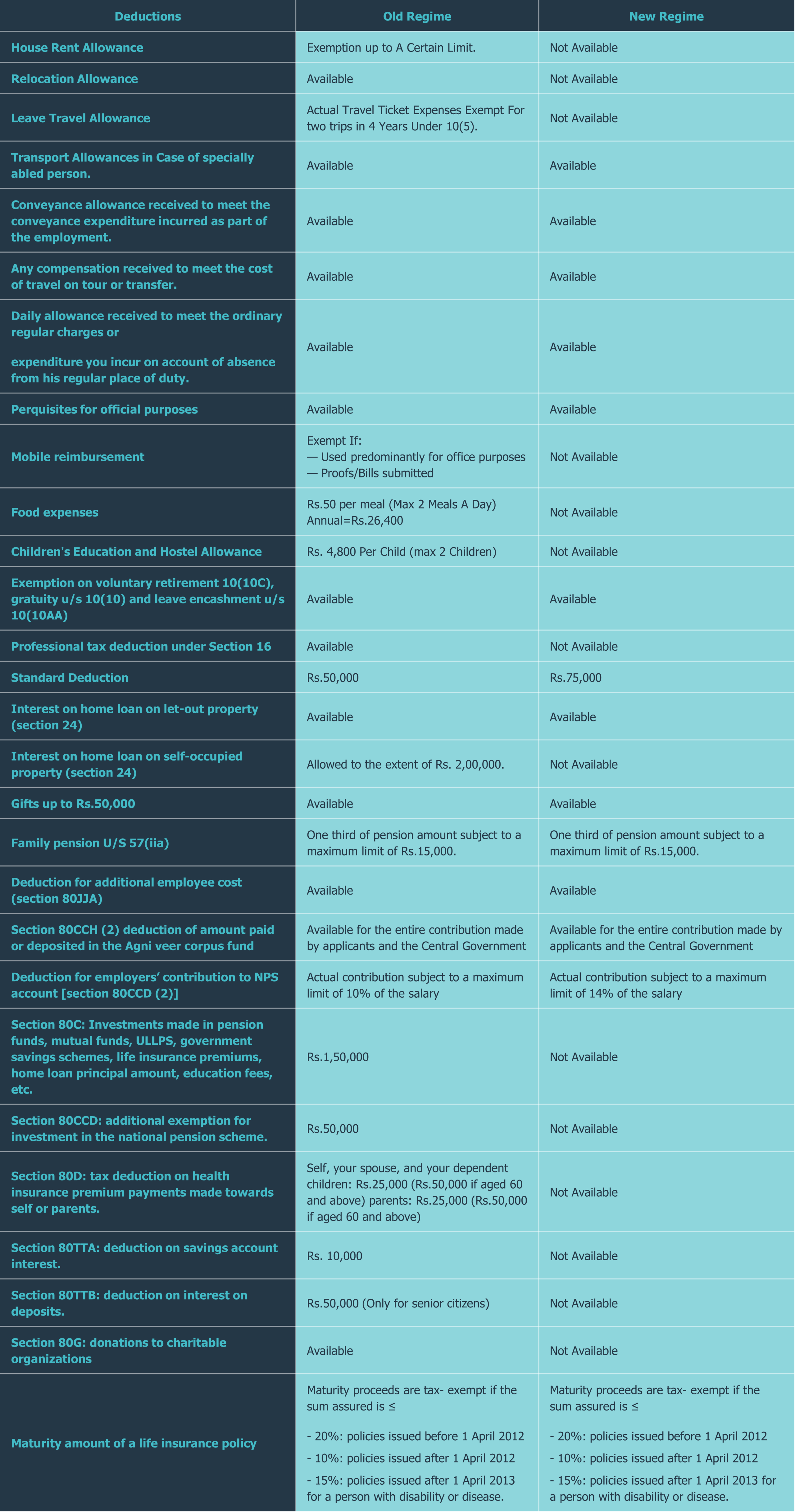

Analysis of deductions – Old Vs New Tax Regime:

How to Choose Between Old and New Tax Regimes?

When choosing between the old and new income tax regimes, it’s vital to assess the tax deductions and exemptions you’re eligible for under the old regime. After applying all applicable deductions—such as those under Section 80C, HRA, and home loan interest—the net taxable income is calculated. This figure can then be used to compare the tax liability under both regimes.

Choose the regime offering lower tax liability.

Inform your employer about your regime selection to ensure accurate TDS.

Strategic regime selection and tax planning can help optimize both current and future tax savings.

Which Regime is Better for FY 2024-25?

The choice between regimes depends on available deductions and exemptions:

Taxpayers with sizable deductions under Sections 80C, 80D, 24(b) or eligible for standard deduction often benefit more from the old regime.

The new regime suits individuals with limited deductions, those managing loan repayments, or seeking a simplified filing process.

Senior citizens may gain more under the old regime, with benefits like Section 80TTB (₹50,000 interest income deduction).

Quick pointers to decide:

Income up to ₹7 lakh with ₹1.75 lakh deductions: No tax in either regime.

Income above ₹7 lakh, deductions ≤ ₹1.75 lakh: New regime may be better.

Deductions > ₹4.5 lakh: Old regime is likely more beneficial.

Deductions between ₹1.75–₹4.5 lakh: Evaluate based on income level.

Conduct a thorough comparison to identify your most tax-efficient structure.

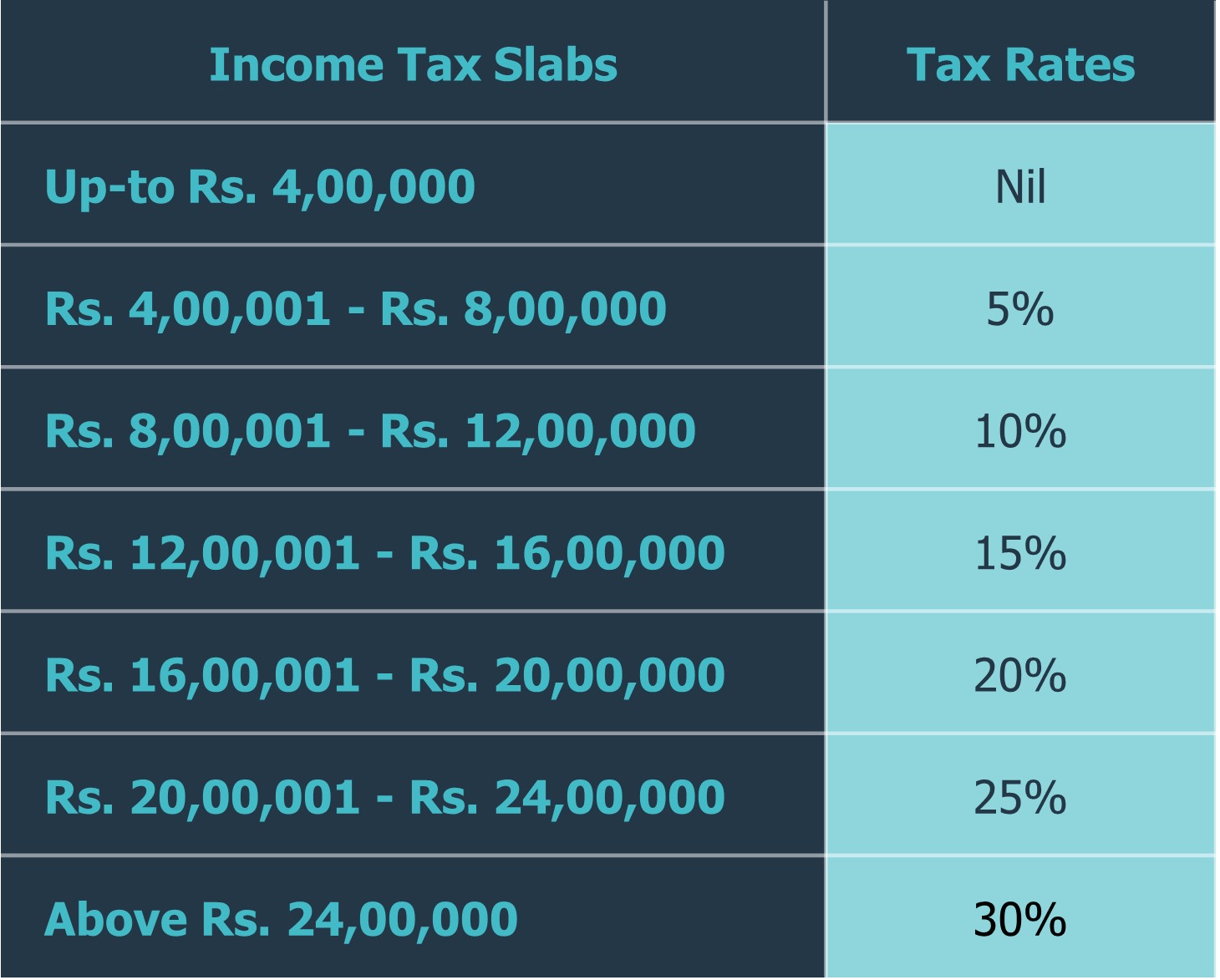

[B] Planning for Upcoming Financial Year 2025-26

Upcoming Changes from FY 2025-26

A major update from FY 2025-26 is that income up to ₹12 lakh under the new tax regime will now attract zero tax liability. This has been made possible by enhancing the Section 87A rebate from ₹25,000 to ₹60,000 under the new regime. As a result, individuals earning up to ₹12,00,000 annually will benefit from complete tax exemption under this structure.

The revised income tax slab rates under the new regime for FY 2025-26 are expected to improve affordability and simplicity for middle-class taxpayers.

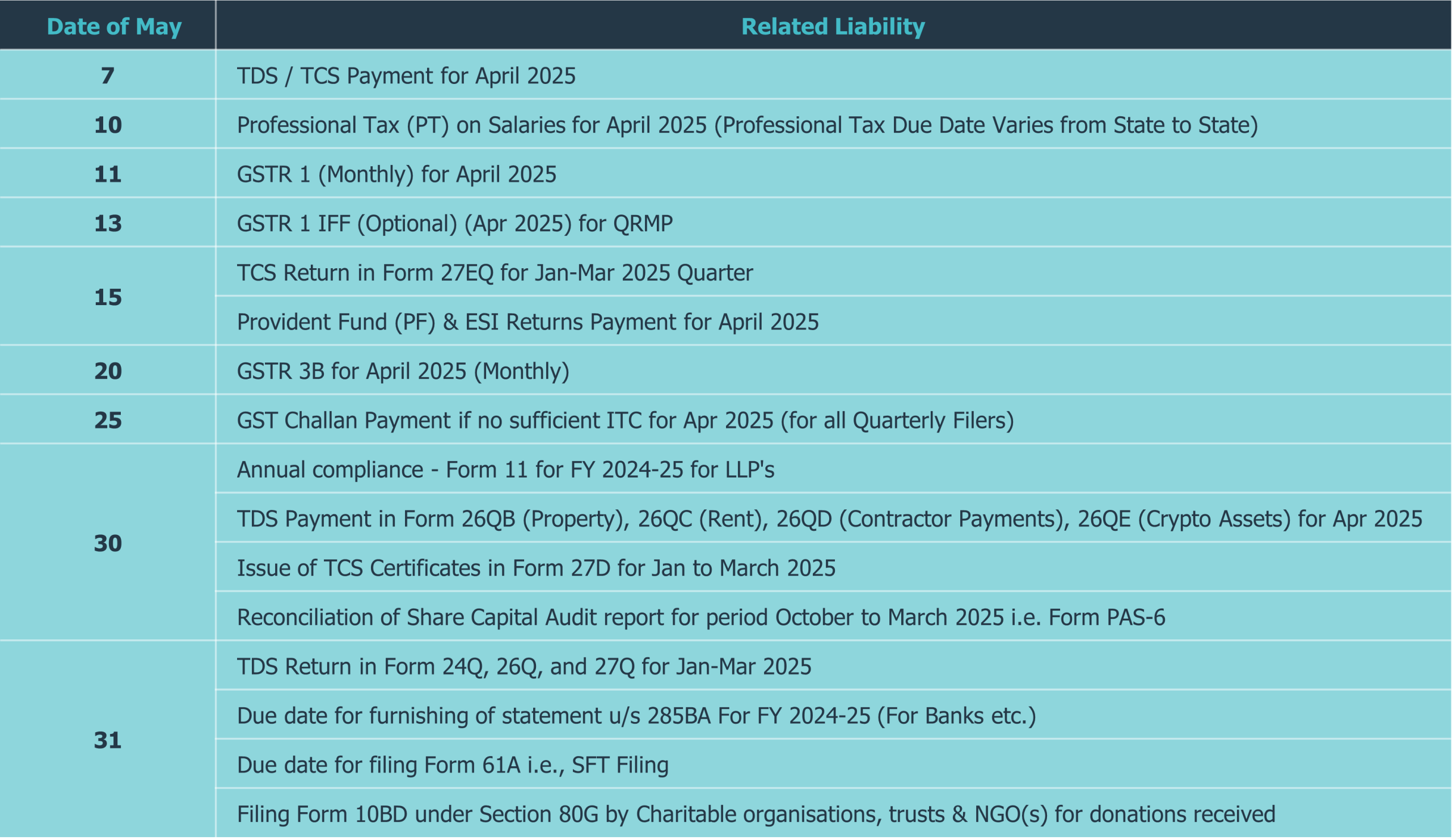

[C] Compliance Calendar for the Month of May, 2025

Conclusion

As the tax landscape evolves with each financial year, staying informed is your strongest tool for making smart financial decisions. Whether you benefit more from the deductions in the old regime or prefer the simplicity of the new one, a careful comparison is essential. With filing season underway and significant changes already announced for FY 2025-26, now is the time to review your finances, consult your advisor if needed, and file your returns with clarity and confidence. Don’t just comply—optimize.

If you’re unsure which tax regime suits you best or have questions about how the recent changes affect your filing, we’re here to help.

💼 Reach out to our tax experts today and get personalized guidance to make informed decisions.

👉 Contact us now and file with confidence.